Small Business Payroll & HR FAQ's

Why do small businesses need payroll software?

Today, running payroll involves a lot more than just paying employees—it also includes tax calculations, filings, wage law compliance, and recordkeeping. A payroll service helps small business owners handle these responsibilities accurately and efficiently, reducing the risk of costly mistakes or penalties. With automated filings, employee self-service, and support from payroll experts, you can spend less time managing paperwork and more time running your business.

What does a payroll provider do?

A payroll service manages every aspect of paying your employees—from calculating wages and deductions to filing taxes and producing year-end forms. Most providers also handle new hire reporting, wage garnishments, and benefits deductions. Paper Trails takes this a step further by offering HR support, compliance guidance, and secure data management—all backed by a local Maine-based team that knows your business.

What features should I look for in small business payroll and HR software?

The best payroll software for small businesses should combine accuracy, automation, and compliance support. Look for features like automatic tax filing, direct deposit, PTO tracking, and employee self-service access. Integrations with accounting software, timekeeping, and onboarding tools are also important. At Paper Trails, small business clients benefit from a single platform that handles payroll, HR, and compliance—plus local experts to help when questions arise.

How can I switch payroll providers?

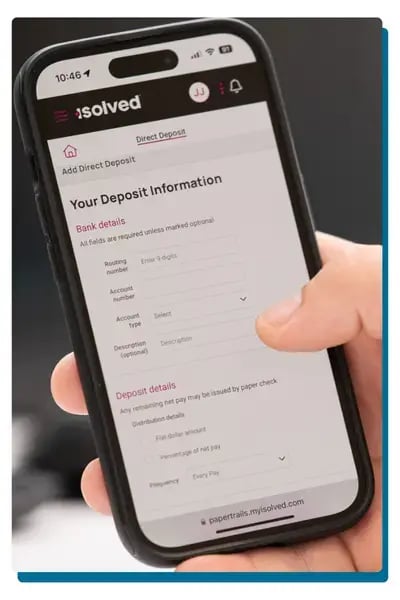

Switching is straightforward when you follow a clear plan. Pick a go-live date (quarter or year start is ideal, but mid-cycle works); gather documents (company info, bank details, pay schedules, employee data, YTD earnings/taxes, PTO balances, deductions, garnishments); confirm state/local tax registrations and rates; run a parallel payroll and reconcile results; communicate to employees (self-service setup, MFA, pay options); close out your prior provider (final run, tax filings responsibility, report downloads, and turn off debits); then go live with post-payroll audits. With Paper Trails, we project-manage the whole transition and do the heavy lifting so your team isn’t stuck in the weeds. Contact our team here to learn more!

How much does payroll services cost for small businesses?

Payroll service costs vary based on the number of employees and the features you need. Most small businesses pay a base fee plus a per-employee charge per pay run. Paper Trails offers transparent pricing with no hidden fees, ensuring you only pay for what your business needs.

Should I outsource payroll if I only have a few employees?

Yes—outsourcing payroll can be one of the smartest moves for small businesses, even with just a few employees. It saves time, ensures compliance, and eliminates the stress of keeping up with changing tax laws and filing deadlines. A trusted payroll partner like Paper Trails helps you stay organized, avoid costly errors, and gain peace of mind knowing your employees are paid correctly every time.

What kind of customer support do you offer?

Unlike national providers that route you through 1-800 numbers and call queues, Paper Trails provides direct access to a dedicated support team that knows your business. Our clients work with real people—local experts who understand complex regulations like Maine PFML and multi-state payroll rules. You’ll get live phone support, proactive communication, and ongoing resources like webinars, guides, and blogs, so your team always feels supported without getting lost in a ticket system.

How secure is your platform?

isolved, our payroll platform, is SOC 1 Type II audited and built with multi-factor authentication, role-based permissions, and advanced security protocols to keep sensitive HR and payroll data protected. At Paper Trails, we take security a step further by educating clients on fraud prevention, helping employees set up MFA, and sharing real-time alerts when new risks emerge. You can trust that your payroll and HR information is both secure and accessible only to the right people, when they need it.

.webp?width=300&height=300&name=Website%20Image%20(8).webp)

.webp?width=200&height=57&name=PT%20-%20Brandmark%20-%20Single%20line%2001%20(1).webp)

.webp?width=600&height=600&name=The%20Paper%20Trails%20Experience%20(4).webp)

.webp?width=400&height=600&name=Service%20Page%20Image%20(3).webp)

.webp?width=400&height=600&name=Service%20Page%20Image%20(4).webp)

.webp?width=400&height=600&name=Service%20Page%20Image%20Employee%20Experience%20(1).webp)

.webp?width=400&height=600&name=Service%20Page%20Image%20Employee%20Experience%20(2).webp)

.webp?width=400&height=600&name=Service%20Page%20Image%20Expense%20(2).webp)

.webp?width=400&height=67&name=seperator%20(600%20x%20100%20px).webp)

.webp?width=960&height=540&name=Paper%20Trails%20Team%20Photo%20(1).webp)

.webp?width=174&height=50&name=PT%20-%20Brandmark%20-%20Single%20line%2001%20(1).webp)