Payroll Year End

Year end for business owners and HR professionals can be a stressful time. Luckily, we have you covered with the resources you need to get you through year end without a hitch.

Need help or have questions? Contact your payroll processor at payroll@papertrails.com.

A Smooth Payroll Year End Starts Here

Year end is one of the busiest — and most important — times for payroll and HR. To make things easier, we’ve built a comprehensive guide to walk you through every step. You’ll find monthly checklists, key deadlines, and practical resources to keep your year-end payroll processing organized and stress-free.

Here are a few highlights from our payroll year-end checklist

2026 Labor Law Changes

-

Maine has increased minimum wage to $15.10 per hour. The cities of Portland and Rockland have increased their minimum wage to $16.75 per hour in Portland and $16.00 per hour in Rockland. Tipped employees in Maine must earn at least $7.55 per hour, or $8.38 per hour in Portland and $8.00 per hour in Rockland. These changes go into effect with the first pay date in January.

-

The “One Big Beautiful Bill” brings several major payroll and HR changes that employers need to prepare for. The bill introduces new federal tax credits for overtime and tip income beginning in 2025, adds new W-2 reporting codes, and requires employers to track overtime and tips more precisely throughout the year.

While the credits reduce the taxes employees pay at filing time, businesses must continue withholding federal income tax until the IRS provides updated guidance.

Employers may also need to update payroll systems, coach managers on employee questions, and prepare for additional compliance changes—from increased dependent care FSA limits to new 1099 reporting thresholds and expanded federal enforcement around I-9s.

The bottom line: this bill adds complexity, and employers should begin planning now to stay compliant.

November Tasks

-

Be sure to have the correct data to when filing your taxes. This includes:

- Federal & State tax ID numbers

- Legal name & business address

- State Unemployment Tax rates

- Employee contact information (names, addresses, social security numbers, and dates of birth)

-

W-2 form previews will be available in the Report Archive with each payroll dated after 11/1. This is a great opportunity to review W-2s for accuracy.

-

In the 2025 session of the Maine Legislature, LD 55 amends Maine’s Earned Paid Leave Law. Employers are now required to allow up to 40 hours of carryover each year, with the ability for an employee to earn up to an additional 40 hours in the following year. Please review your Earned Paid Leave policies as applicable. If you need help with updating your policies, our HR Consulting team is ready to assist!

-

All Maine employers with 5 or more employees are now required to provide access to a retirement plan for their employees. This requirement can either be met via a company-sponsored plan like a SIMPLE IRA or 401(k) or through the state’s Roth IRA program, MERIT.

-

Before Friday, December 12th, all W-2 adjustments must be submitted to Paper Trails for processing. W-2 adjustments include the following items:

- S-Corporation Shareholders’ Health Insurance Premiums and Mileage Reimbursements

- Group term life paid on behalf of employees over $50,000

- Third party sick pay

- Personal use of a company vehicle

- Non-cash payments like gift cards or other “fringe benefits”

-

If you and your associated businesses have more than 50 Full-Time Equivalent Employees, you will need to prepare and submit 1095-C forms to your employees.

December Tasks

-

Third party sick pay is an insurance benefit often called short or long-term disability insurance. If an employee has used this benefit during the year, you will likely need to report taxes and wages through payroll. While these payments are not made through the employer, the taxes must be reported by the employer. Your disability insurance provider will send you quarterly statements.

-

Have you paid employees by manual checks outside of payroll? You must record those manual checks on payroll to ensure that all wages are legal. Further, third party sick pay, personal use of an employer-provided vehicle, qualified moving expenses, club memberships and more must be reported on W2s!

-

To ensure smooth processing, bonuses must be submitted at least 5 business days before the payment date (ex., Friday bonuses submitted by the prior Monday). Bonus runs are processed separately from regular payroll. If a bonus creates a tax or deposit over $100,000, it must be funded by wire transfer, and we’ll contact you to coordinate.

To submit bonus payroll requests, start by contacting your payroll processor at payroll@papertrails.com.

-

Each December, every state issues updated unemployment rates to every employer. If you have employees in states other than Maine, please forward these notices to your payroll processor via email as soon as you receive them to ensure that your first payrolls of the year are correct.

-

Please carefully review your final payroll of the year. There are several items to review:

- Employee names, addresses and social security numbers should be reviewed and accurate.

- Final benefit deductions, PTO pay outs, fringe benefits, etc should be reviewed and accurate.

January Tasks

-

Many employees or owners like to maximize pre-tax retirement benefits. Update employee deduction amounts to ensure the maximum contributions are made for the year.

-

For 2026, HSA and FSA contribution limits are increasing. Now is a good time to review your accounts and make sure you’re maximizing your tax savings.

-

In the 2026 calendar year, there are 53 Thursdays. If you have a Thursday pay day, and you pay your exempt (salaried) employees based on an annual salary, you may want to consider adjusting their weekly or bi-weekly payroll amount to accommodate for a potential additional check. This may or may not apply to you, but we don’t want you to be caught flat-footed at the end of the year and potentially overpay an exempt employee when you didn’t want to.

-

Please carefully review your first payroll of the year, including:

- Pay rate changes, including minimum wage updates

- Deduction and benefit changes

- PTO carryovers and balances

-

It is your responsibility to distribute/mail W-2s & 1099s to your employees before January 31st!

-

You must display both federal and state labor law posters prominently in your business for all employees to review. These are published for free by the federal and state governments. You should download, print and display the most accurate labor law posters which are available here.

Holiday Schedule

Here are some important dates that Paper Trails and banking hours may be impacted. Be sure to submit payroll timely to ensure your employees are paid on time.

Thanksgiving Holiday 🦃

Paper Trails and banks will be closed on Thursday, November 27th for Thanksgiving. Paper Trails will be closed on Friday, November 28th but banks will be open.

Christmas Holiday 🎄

Paper Trails will close early (at 12pm) on Wednesday, December 24th for Christmas Eve. Paper Trails and banks will be closed on Thursday, December 25th for Christmas.

New Year's Holiday 🍾

Paper Trails will close early (at 12pm) on Wednesday, December 31st for New Year's Eve. Paper Trails and banks will be closed on Thursday, January 1st for New Year's Day.

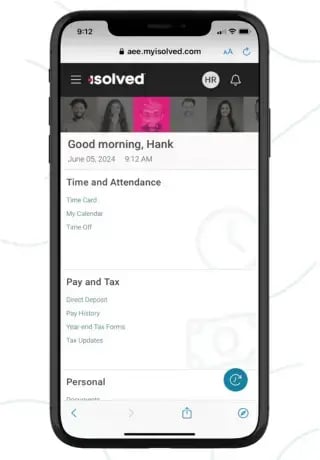

Download the isolved People Cloud Mobile App

Don't forget about the isolved People Cloud mobile app for employees.

Employees can access their pay stubs, change their direct deposit information, clock in and out, request time off (if enabled) and even retrieve their W2s all online without ever having to bother you! All you need to get started is each employee’s email address. Full instructions on how to enable access to the app for your employees is available at papertrails.com/self-service. If employees are having trouble logging in from the isolved app, helpful tips & tricks for password resets and more are located at papertrails.com/help.

Contact your payroll processor if you have further questions or need help activating this feature. Download the app from the Apple and Androitd app stores today!

Stay Up-to-Date On Key Compliance & HR Tips

Our team at Paper Trails posts regularly on social media. These posts are most often important compliance news, HR & payroll tips and industry information that will impact your business! Be sure to follow across all of our platforms to stay up to date! Sometimes, we even post a funny video or two 😉!

Can’t find what you’re looking for? Contact our local team.

We’ll stay in the weeds to manage your payroll, Human Resources, and compliance needs.

.webp?width=300&height=300&name=Website%20Image%20(8).webp)