So, you’re a small business owner with big dreams. Not only are you dedicated to your business, but to your employees as well. Which means you’re thinking about some of the most valuable benefits you can offer. One of the top benefits your employees look for are retirement plan options. You’ve heard about the financial security and employee retention benefits they can bring, but you’re navigating a topic that you do not know. Where do you start? How do you choose the right plan? And what on earth is a 3(16) fiduciary?

At Paper Trails, we understand that small business owners like you can find the complexities of retirement plans difficult. There are so many aspects that go into them, especially 401(k)s. And one of the aspects of a 401(k) that can confuse shoppers is the idea of a 3(16) fiduciary. In this article, we’ll cover the concept of a 3(16) fiduciary, explore the importance of plan fiduciaries, and help you distinguish between them and third-party administrators. So, let’s get started.

What is a 3(16) Fiduciary?

A 3(16) fiduciary, often referred to simply as a “plan fiduciary,” is a key player in retirement plans, especially for small businesses looking to establish a 401(k) plan. At its core, a 3(16) fiduciary is an individual or entity appointed to take on certain administrative responsibilities and fiduciary duties within the plan. These duties can include tasks such as plan document maintenance, participant notifications, and compliance monitoring. Essentially, they ensure that your retirement plan operates smoothly and remains in compliance with the Employee Retirement Income Security Act (ERISA). They are there to take the hassle of managing the plan off of small business owners and HR professionals plate.

Why Do You Need a Plan Fiduciary?

The role of a plan fiduciary is critical in running a 401(k) plan effectively. Here are a few important reasons why having a plan fiduciary is essential for your small business:

- Legal Compliance: ERISA regulations can be complex and tedious. A 3(16) fiduciary’s expertise ensures that your plan is always in compliance, reducing the risk of legal issues and penalties.

- Operational Efficiency: With a fiduciary in place, administrative tasks are handled by experts, freeing up your time to focus on your business.

- Participant Protection: Fiduciaries are responsible for participant communications, ensuring that employees understand their plan and how it works, which can lead to higher participation rates.

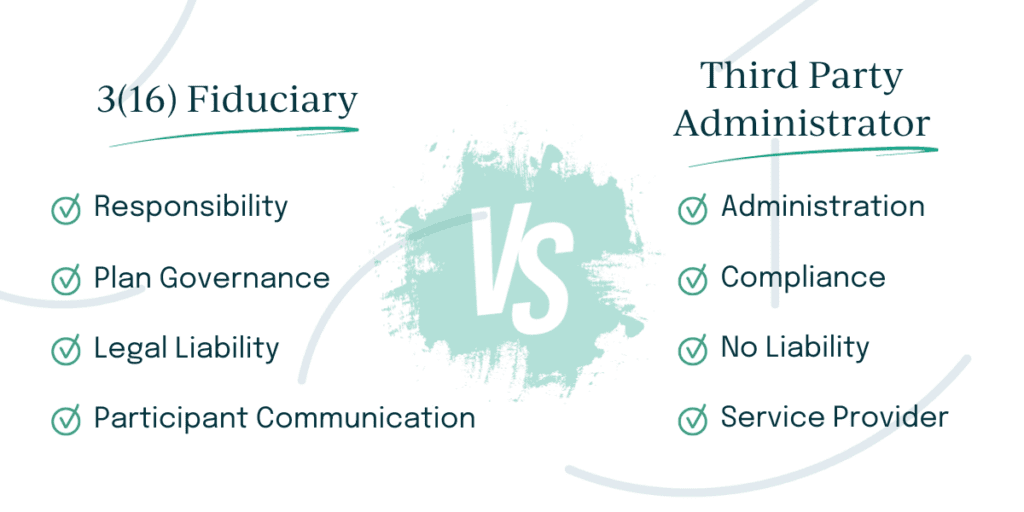

3(16) Fiduciary vs. Third-Party Administrator (TPA)

So, a 3(16) fiduciary sounds a lot like a third party administrator (TPA), right? It’s common for people to confuse 3(16) fiduciaries with third-party administrators, but they serve different roles within your 401(k) plan:

3(16) Fiduciary:

- Responsibility: A 3(16) fiduciary is primarily responsible for administrative and fiduciary duties related to a retirement plan. This includes ensuring that the plan is in compliance with the Employee Retirement Income Security Act (ERISA) and other relevant regulations.

- Legal Liability: A 3(16) fiduciary assumes a significant level of legal liability for the proper administration of the plan. They can be held personally responsible for any compliance failures or errors in plan management.

- Plan Governance: A 3(16) fiduciary helps establish and maintain plan governance procedures. They make decisions about the plan’s operation, including the selection and monitoring of investment options.

- Participant Communications: They are responsible for communicating important plan information to participants, such as plan changes, investment options, and distribution options.

Third-Party Administrator (TPA)

- Administrative Focus: A TPA primarily focuses on the administrative aspects of a retirement plan. They handle tasks like recordkeeping, contribution processing, and distribution processing.

- Compliance Support: While TPAs play a role in ensuring plan compliance, their responsibilities in this area are typically narrower than those of a 3(16) fiduciary. They may assist with compliance testing and reporting, but ultimate responsibility lies with the plan sponsor or the 3(16) fiduciary.

- No Personal Liability: TPAs do not take on the same level of personal legal liability as a 3(16) fiduciary. Their responsibilities are contractual, and they are generally not held personally liable for compliance failures.

- Service Provider: TPAs are often seen as service providers who offer support to the plan sponsor (the business owner). They help with the technical and operational aspects of running the plan smoothly.

How Should Small Businesses Proceed in Researching 401(k) Options?

Now that you have a better understanding of 3(16) fiduciaries and their importance, here are some steps to guide you in researching 401(k) options for your small business:

- Assess Your Needs: Start by evaluating your business’s unique needs, including your budget, the number of employees, and your long-term retirement goals.

- Seek Professional Guidance: Consider consulting with retirement plan experts who can help you navigate the complex world of 401(k) plans, including the selection of a 3(16) fiduciary.

- Compare Providers: Research different 401(k) providers and inquire about their offerings, fees, and the level of support they offer for plan administration.

- Educate Your Team: Lastly, educate your employees about the benefits of the 401(k) plan you’re considering, as their engagement is key to its success.

Conclusion

You should now know that a 3(16) fiduciary plays a vital role in ensuring the success and compliance of your small business’s 401(k) plan. By understanding their role and taking the right steps to research your options, you can set up a retirement plan that benefits both your employees and your business’s long-term financial health. Contact our team if you are looking for more information on how we can help with your benefits and retirement plans, or for a referral to a trusted retirement partner.