In the world of employment law, one of the most common mistakes employers make is the misclassification of employees. A report from the U.S. Department of Labor indicates that up to 30% of employers may misclassify their employees. This misstep not only leads to legal complications but also affects the rights and benefits of workers. Understanding the differences between exempt vs non exempt employees is not just a legal requirement but a fundamental aspect of ethical and efficient business management.

In this article, we will look at exempt vs non exempt employee classifications. You will learn about their distinct pay structures, typical work schedules, and the specific job duties that define each category. Additionally, we’ll review the consequences of misclassifying an employee. By the end of this article, you will have a clearer understanding of whether your employees should be classified as exempt or non exempt, ensuring your business adheres to legal standards and fosters a fair workplace.

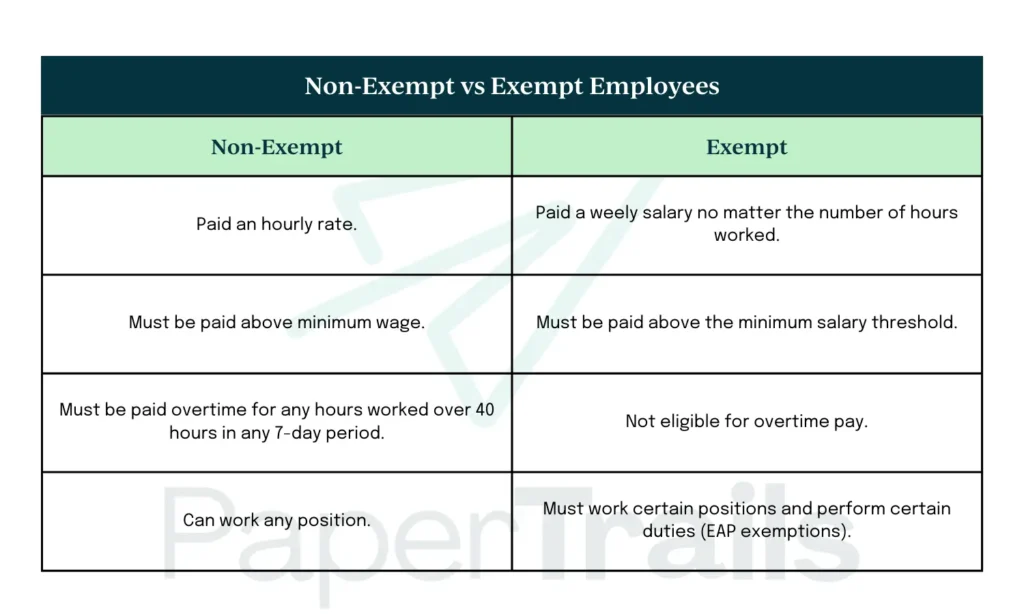

Differences between exempt vs non exempt employees

While there are a few differences between classifying your employee as exempt or non exempt, the biggest difference comes down to how you pay them. Following guidelines set by the Fair Labor Standard Act, exempt employees are paid a salary of at least a certain amount that is set by state and federal governments and are not eligible for overtime pay. On the other hand, non exempt employees are paid an hourly rate that at least meets the minimum wage. These employees must be paid (blended)overtime for any hours worked over 40 hours in any 7 day period. Let’s take a closer look at both types of employees.

What are exempt employees?

Exempt employees are typically salaried workers. They receive a fixed amount of income annually, divided over each pay period. Unlike hourly employees, their pay is not directly tied to the number of hours worked. Federally, the Fair Labor Standards Act (FLSA) mandates that exempt employees must earn at least $684 per week or $35,568 annually. Many states have a higher minimum salary threshold, so be sure to check you state requirements to be sure you are in compliance.

What is their work schedule like?

Exempt employees often adhere to a standard “9-to-5” work schedule. However, the FLSA does not mandate a minimum number of hours or time of day for exempt employees. Thus, they may work more or less than the typical 40-hour workweek without impacting their salary. Exempt employees are not eligible for overtime pay. This means that they are paid the same amount per week whether they work 30, 40, or 50 hours.

What duties tests need to be met?

To qualify as exempt, employees must pass specific duties tests. These include performing high-level tasks consistent with certain roles. Job titles alone do not determine exempt status; it’s the nature of the work and the level of responsibility that count. Job classification and duties test set by the Department of Labor state that exempt employees must be “white collar” and perform duties within one of the following EAP categories:

Executive Exemption

- Primary Duty: The primary duty of an executive employee must be managing the business or a certain department.

- Management Role: This includes the authority to direct the work of other employees and to make decisions on hiring and firing.

- Regular Supervision: An executive must regularly supervise at least two or more full-time employees.

Administrative Exemption

- Primary Duty: The primary duty is the performance of office or non-manual work directly related to management or general business operations.

- Discretion and Independent Judgment: The employee has the authority to make important decisions without significant oversight.

Professional Exemption

- Primary Duty: The primary duty must be work requiring advanced knowledge, predominantly intellectual in character and which includes work requiring the consistent exercise of discretion and judgment.

- Advanced Knowledge: This must be in a field of science or learning customarily acquired by a prolonged course. This category includes roles such as lawyers, doctors, architects, engineers, and teachers.

What are non exempt employees?

Non exempt employees are paid an hourly rate of any amount greater than state and federal minimum wage. These employees must be paid overtime of 1.5 times their rate for any hours worked over 40 hours in a given 7 day period. Non exempt employees who work different position at multiple rates of pay are subject to blended overtime.

What is their work schedule like?

Non exempt employees often have variable work schedules, which can change weekly or even daily. They are usually required to track their work hours to accurately calculate wages, including overtime.

What types of jobs can non exempt employees work?

These employees can have positions that are diverse, ranging from manual labor roles like carpentry and mechanics to service-oriented jobs in retail and hospitality. These roles often involve specific tasks and direct supervision.

How do taxes for exempt and non exempt employees work?

Both exempt and non exempt employees are subject to the same federal, state, and local income taxes. Employers withhold these taxes from their paychecks. Additionally, employers must withhold certain FICA payroll taxes from both types of employees. A full breakdown of payroll taxes can be found here. The primary difference between the two lies in bonuses are taxed, which can vary based on the individual’s total income and tax bracket.

What happens if I misclassify an employee?

Misclassifying an employee, whether intentionally or accidentally, can lead to significant legal and financial consequences. Employers may face fines, back pay for overtime, tax implications, damaged reputation and even lawsuits. It’s imperative to accurately classify employees to comply with labor laws and avoid these risks.

If you think you have employees that are misclassified, take the following steps:

- Conduct an Internal Audit: Review job roles and duties to ensure they align with FLSA criteria for exempt and non exempt statuses. This audit should include examining job descriptions, actual job duties, and compensation structures.

- Reclassify Employees as Necessary: If you find that employees have been misclassified, reclassify them as soon as possible. This involves changing their status to either exempt or non exempt based on their job duties and compensation.

- Calculate and Pay Back Wages: For employees who were misclassified as exempt and should have been non exempt, calculate the back wages owed, including any overtime pay. Pay these amounts as promptly as possible to minimize additional penalties and interest.

- Update Payroll Records and Systems: Adjust your payroll system to reflect the correct classification and ensure that future paychecks are accurate. This includes updating tax withholdings and contributions.

- Communicate with Affected Employees: Be transparent and inform affected employees about their new classification and how it impacts their pay, work hours, and benefits. Address any concerns they may have and assure them that the changes are being made to comply with labor laws.

How should I classify my employees?

Determining whether employees should be classified as exempt or non exempt depends on their job duties, pay structure, work hours and your business’ particular needs. It’s crucial to consider both the FLSA guidelines and the specific roles and responsibilities within your organization. Each business is different. If you have employees that are working more than 40 hours and are receiving overtime pay weekly, making them an exempt employee may be the right move. On the other hand, if you are a business that has dramatic seasonal swings, for example, paying overtime to your employees for the busy season may be more beneficial than paying a higher salary rate to an exempt employee year round.

Take a look at your scenario to see which option might work best for your business. If you are paying out too much overtime to your exempt employees, please read our strategies for reducing overtime article. And feel free to reach out to our team for assistance with your payroll or HR needs!